As 2025 draws to a close, South Africa’s commercial property sector stands on firmer, more confident ground than it has in years. What began with cautious optimism has evolved into measurable momentum, supported by political stabilisation, clearer monetary policy, and a significant shift in global perception.

At Anvil Property Smith, our brokers across South Africa have been tracking these shifts throughout the year. 2025 proved to be a year defined by structural improvements, renewed investor appetite, and clearer signals of where sustainable value is emerging.

South Africa’s Grey List Exit: The Turning Point of 2025

South Africa’s removal from the Financial Action Task Force (FATF) grey list in November 2025 is widely regarded as the year’s most meaningful milestone. The exit restored global confidence, reduced the country’s risk profile, and immediately improved the ease of doing business.

Why does this matter for commercial property?

A lower risk premium accelerates investment activity. At Anvil, we saw almost immediate changes:

- Faster deal turnaround times

- Improved access to development finance

- Renewed interest from foreign buyers and private equity

- A clearer appetite for income-generating assets in logistics and office sectors

“Now that we’re off the grey list, clients are moving faster. Finance is flowing more easily, especially for larger, well-located assets,” notes Lydon Hanger-Hill, one of Anvil’s Johannesburg commercial specialists.

Combined with a stable monetary policy (repo steady at 7.00%) and a calmer political environment post-2024 elections, the stage was set for a steadier, more predictable 2025.

Industrial Property Continues to Lead – And Pull Away

The industrial sector once again outperformed all other commercial categories in 2025. For Anvil’s national industrial teams, the drivers were clear and structural:

- Rising e-commerce

- Regional distribution expansion

- Upgraded supply chains

- Demand for modern warehousing with 12m–15m eaves

- Limited speculative development tightening supply

This supply-demand imbalance kept industrial vacancies near record lows and sustained strong rental escalations.

In Cape Town, high-demand nodes include Kraaifontein and Paarden Eiland, where vacancy rates remained exceptionally low. In Johannesburg, Midrand continues to perform well, especially for light-industrial and warehousing users seeking access to the N1 logistics corridor.

Regional Standouts (based on Anvil’s on-the-ground leasing activity):

- Cape Town led national rental growth with a year-on-year increase of ±15%, supported by strong municipal performance and an effective zero-vacancy environment in key nodes such as Airport Industria, Montague Gardens, and Blackheath.

- Durban remains constrained by land availability, yet logistics nodes such as Riverhorse Valley and Cornubia continue to command premium rents.

- Johannesburg nodes such as Kyalami, Linbro Park, and Jet Park remain hubs for logistics and light manufacturing, with strong activity in the 1,000m²–4,000m² range.

Office Market: Flight to Quality Now a Fixed Reality

While South Africa’s broader office market still carries structural vacancy risks, 2025 marked a decisive shift in tenant behaviour.

Prime office vacancies dropped to 6.8% as companies finalised their long-term hybrid strategies and prioritised quality over quantity. This shift represents the strongest prime-grade performance seen since before the 2020–2022 hybrid transition period.

Key drivers Anvil brokers reported:

- Energy resilience – Solar, inverters, and water backup are now leasing fundamentals.

- Efficiency – Tenants prefer smaller, smarter, greener spaces.

- Location consolidation – Nodes like Century City, Sandton, and Rosebank outperformed secondary or fringe nodes.

“Tenants want buildings that work harder for them – lower utility costs, secure access, and future-proof design,” says Marnitz van den Bergh, one of our Cape Town office specialists.

Older B- and C-grade buildings continue to struggle, accelerating the demand for asset repositioning, with some landlords exploring conversions or deep retrofits.

Retail: A Market Finding Its Balance

2025 saw a clear divergence in retail:

- Large-format malls faced higher operational costs and slower foot traffic.

- Convenience and neighbourhood centres thrived, driven by accessibility, essential services, and localised consumer behaviour.

E-commerce, now a R480 billion sector, isn’t killing physical retail – it’s forcing an evolution. The most resilient retail environments combine:

- Fulfilment integration

- Everyday convenience

- Food & lifestyle anchors

- Experience-based tenants

Neighbourhood centres anchored by essential services, pharmacies, and everyday-convenience retail continued to outperform regional malls in both foot traffic and tenant stability.

Where Investors Are Placing Capital

Anvil’s investment team observed a consistent theme in 2025:

Capital followed infrastructure and governance.

Prime industrial yields tightened to ±9.4%, remaining competitive relative to government bonds (±11.4%) when properties were backed by:

- Reliable municipal performance

- Upgraded logistics routes

- Solar-ready infrastructure

- Strong tenant covenants

Logistics-focused assets, particularly those with modern warehouse configurations and strong lease covenants, attracted the highest level of buyer activity during 2025.

The government’s R1 trillion infrastructure programme is starting to show real-world impact, especially in energy, water security, and freight logistics. Properties aligned with these improvements captured the most investor attention.

2026 Outlook: Sustainable Growth, Improved Confidence

As we look toward 2026, the tone is not hyper-optimistic – it’s measured, confident, and grounded in improved fundamentals.

1. Grey List Exit Momentum to Accelerate Activity

We expect increased transaction volume in Q2–Q3 2026, especially for:

- Capital-intensive industrial builds

- Large office consolidations

- Cross-border corporate deals

- Prime logistics investments

This is expected to include renewed interest from foreign corporates that paused entry into the South African market during the grey-list period.

2. Industrial Demand Stays Strong, But Growth Stabilises

Rental growth may normalise as new industrial supply enters the market. However, demand for modern facilities remains robust, especially in:

- Cape Town logistics corridors

- Durban’s N3 and Dube TradePort regions

- Johannesburg’s northern distribution zones

New industrial supply entering the market may temper escalation slightly, but the structural demand drivers remain intact, especially in energy-secure nodes.

3. Green Buildings Move From “Advantage” to “Requirement”

Whether office, industrial, or mixed-use, sustainability is no longer optional.

Retrofitting is the next frontier:

- Solar PV

- Smart metering

- Water harvesting

- Energy management systems

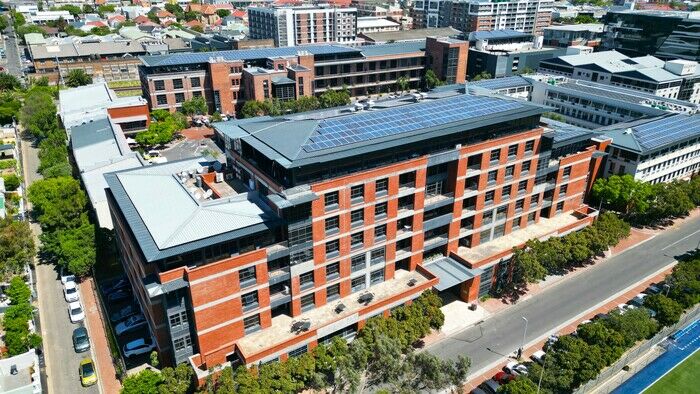

A standout model of this shift is Black River Park in Observatory, Cape Town - one of South Africa’s most advanced, green-certified office precincts. The park combines large-scale solar infrastructure, reliable backup power and water, and efficient building performance, making it a top choice for businesses that prioritise sustainability and operational resilience. Its extensive solar generation capacity remains one of the largest privately owned rooftop arrays in the Southern Hemisphere, strengthening its position as a benchmark for sustainable office parks in South Africa.

4. Capital Becomes Laser-Focused on Reliable Municipalities

Investors will increasingly price in service reliability and governance quality when making acquisition decisions.

“In 2026, the winners will be the nodes that work – where power is stable, roads are maintained, and you can actually get things done,” says Tyler Guise-Brown, part of Anvil’s Durban industrial broker team.

2025 marked the beginning of a long-awaited turning point. The South African commercial property market is not soaring, but it is stabilising, maturing, and rebuilding momentum.

For several years, the market moved like a vehicle driving with the handbrake on. With grey listing resolved, political uncertainty easing, and infrastructure investment underway, that handbrake is finally being released.

There is still a need for careful navigation – especially around municipal reliability and macroeconomic headwinds – but the market is undeniably regaining traction.

For business owners, landlords, and investors, 2026 presents a strategic window:

A chance to invest deliberately, leverage improved fundamentals, and align property decisions with long-term value.

At Anvil Property Smith, we believe the next 12 months will reward those who act early, focus on quality assets, and choose future-ready locations.

Frequently Asked Questions

1. Which property sectors are expected to perform best in 2026?

Industrial and logistics remain the strongest-performing categories, driven by e-commerce, regional distribution growth, and demand for modern warehousing. Prime-grade offices in well-run nodes such as Rosebank, Sandton, and Century City are also expected to continue recovering.

2. Will industrial rentals continue rising in major metros?

Yes, but rental growth is likely to stabilise slightly as new supply enters the Johannesburg and Cape Town markets. Demand will remain highest in energy-secure, high-performance logistics corridors, especially those near key highways, ports, and intermodal transport routes.

3. How does South Africa’s grey list exit affect commercial property?

Exiting the FATF grey list lowers the country’s risk profile and improves the ease of doing business. This typically accelerates financing approvals, increases foreign investor confidence, and boosts transaction volumes, particularly for large logistics, office consolidation, and industrial acquisition deals.

4. What should investors focus on when evaluating commercial property in 2026?

Investors should prioritise:

- Municipal reliability (power, roads, water, service levels)

- Energy resilience (solar, backup systems, consumption monitoring)

- Tenant covenant strength

- Access to logistics infrastructure

- Green building readiness

These factors increasingly influence yield, vacancy risk, and long-term asset performance.

5. Which regions are attracting the most demand for industrial property?

Highest demand continues to be seen in:

- Cape Town’s Airport Industria, Montague Gardens, and Blackheath

- Durban’s N3 corridor and Dube TradePort region

- Johannesburg’s Linbro Park, Kyalami, Midrand, and Jet Park logistics belts

These nodes offer superior accessibility, modern facilities, and strong tenant activity.

6. Are businesses still downsizing office space?

Most businesses have now completed their hybrid restructuring. Downsizing continues in older, less-efficient buildings, while prime office space in well-run nodes sees positive absorption, driven by tenants seeking energy resilience, amenities, and long-term operational stability.

7. Is this a good time to expand or consolidate commercial space?

Yes. With improved confidence, stabilising interest rates, and better infrastructure momentum, 2026 presents a strategic window for:

- locking in quality office space at competitive rentals,

- securing well-located warehousing before supply tightens again, and

- repositioning underperforming assets through retrofits or sustainability upgrades.

8. What types of buildings will lead the market in the next cycle?

Future-ready buildings that prioritise sustainability, energy efficiency, smart systems, and operational resilience will outperform. Examples include:

- solar-enabled industrial facilities

- modern last-mile logistics hubs

- green-certified office parks like Black River Park

- mixed-use precincts with integrated amenities

About Anvil Property Smith

Anvil Property Smith is a national commercial and industrial brokerage specialising in commercial property to let, industrial property to let, and investment-grade real estate across South Africa. With teams operating in Johannesburg, Pretoria, Cape Town, Durban, and key regional nodes, Anvil provides market-tested insight, tenant representation, landlord advisory, and strategic property solutions for businesses of every size.

Our teams work across major nodes to match clients with high-performance office space to let, warehouse to rent, logistics facilities, and industrial property to let in South Africa’s most active regions.

Whether you're expanding, relocating, or investing, Anvil delivers property intelligence that drives confident decision-making in a fast-evolving market.