Warehouses to Let in Pomona – A Logistics Hub Forging Its Own Path

If you're looking for industrial space near OR Tambo with proper infrastructure and lease-ready options, Pomona is probably already on your radar. It’s not some speculative fringe play — it’s where serious logistics operators, e-commerce brands, and national distributors are actively running. And not just running, thriving. We work these parks every week, and the pace is fast. Demand's high. Stock moves quickly. But if you know what you’re after, you can still lock in quality space at fair rates.

This guide breaks down Pomona for what it really is: a logistics machine with wide roads, modern warehousing, and some of the best freight connectivity in Gauteng.

Area Overview

Pomona sits on the eastern flank of Kempton Park, right next to the R21. It’s five minutes from OR Tambo International and just off the arterial routes that move goods through Gauteng and beyond. What used to be farmland is now an engineered industrial zone with real throughput capacity. We're talking purpose-built parks, big-box specs, and room to scale. It’s not an old industrial area rehashed — it’s been designed for today’s logistics and manufacturing operators from day one.

Accessibility is a major part of the story here. Pomona connects into the R21, R24, N12, and N3 with ease, placing it squarely in Gauteng's central logistics corridor. Whether you're moving goods to the port, inland depots, or last-mile destinations, this hub keeps things flowing. OR Tambo? Five minutes. Johannesburg CBD? Thirty. Pretoria? Around forty. And with direct connectivity to Rhodesfield and Van Riebeeck Park Gautrain stations, staff access is sorted too.

Importantly, Pomona isn't isolated. It's plugged into a broader development engine that includes the Riverfields precinct, which is undergoing rapid investment. Equites has driven major builds there, Fortress is expanding Eastport Logistics Park, and Newlyn is rolling out one of their flagship projects in Newlyn Park. Together, these nodes are shaping the next generation of Gauteng logistics.

Business & Market Insights

Pomona isn’t catching up to the curve — it set the pace over the last five years. DSV, DHL, Takealot, Onelogix, Emit, Andru Mining, and Wirtgen have all chosen this node for a reason: it works.

Key industrial activity in Pomona includes:

- Distribution hubs

- E-commerce fulfilment centres

- Tech-enabled logistics

- Light manufacturing

- Construction and mining supply operations

You’re not out on a limb here. You’re in the company of operators who value performance, location, and infrastructure.

Infrastructure & Accessibility

Pomona’s entire value proposition leans on accessibility. You can hit the R21 in under 2 minutes from most parks, and from there you’re 5 minutes to OR Tambo, 30 to Joburg CBD, and 40 to Pretoria. It’s quick, clean access with no back-street mess or industrial gridlock.

Key access points:

- R21 highway (primary freight artery)

- R24 and N12 for East Rand connectivity

- N3 to Durban or northern freight routes

- OR Tambo International Airport: under 5 minutes

- Gautrain stations at Rhodesfield and Van Riebeeck Park

For staff access, Pomona holds up well. Minibus taxis are active along the main roads, and surrounding suburbs like Kempton Park, Benoni, and Tembisa supply a solid labour pool for logistics and light industrial roles.

Property Landscape (Office Parks + Specs)

Let’s be upfront here — Pomona’s industrial appeal means that space, across almost all size bands, is tight. From smaller modules of 300–500m² to the larger 5,000m²+ boxes, availability can be limited. This is a node where the best units often lease before completion.

Popular parks within the area include:

Pomona Junction

Offers flexible, modular warehousing from 300–1,000m². The park is superlink-accessible, provides 24/7 security, and all units come standard with three phase power. It’s one of the few places where you can find quality space at the smaller end of the market.

Aquaplan, Greendrop, and Blue Drop Industrial Parks

These parks cater to the 500–1500m² range with modern units featuring high eave heights, three phase power, and well-finished office components. They suit manufacturing, fabrication, and smaller logistics operators needing functional workspace with strong finishes.

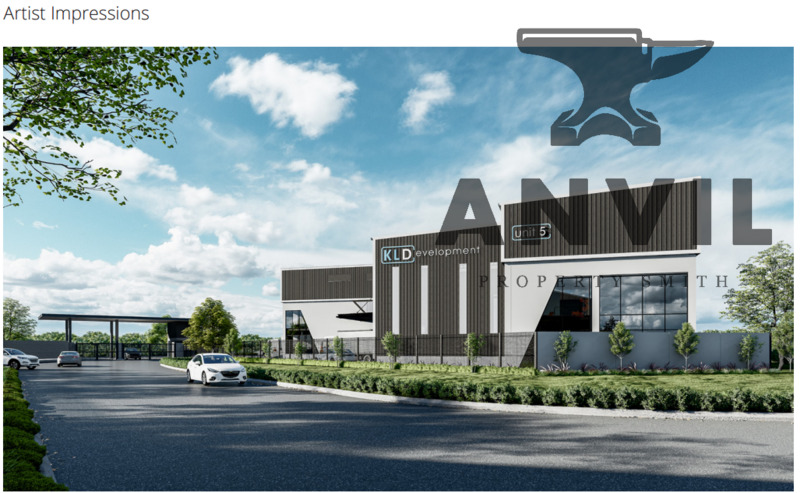

KL Developments

Still the pace-setter when it comes to mid-size logistics. Their pipeline includes:

- X190: Modular units from 1,000–2,000m², overhead sprinklers, dock levellers, 30m yard depth, and exposure onto main arterials.

- Logistics Hub 2: Similar spec and size range, also launching within the next year. Net rentals in these parks are sitting at R95/m².

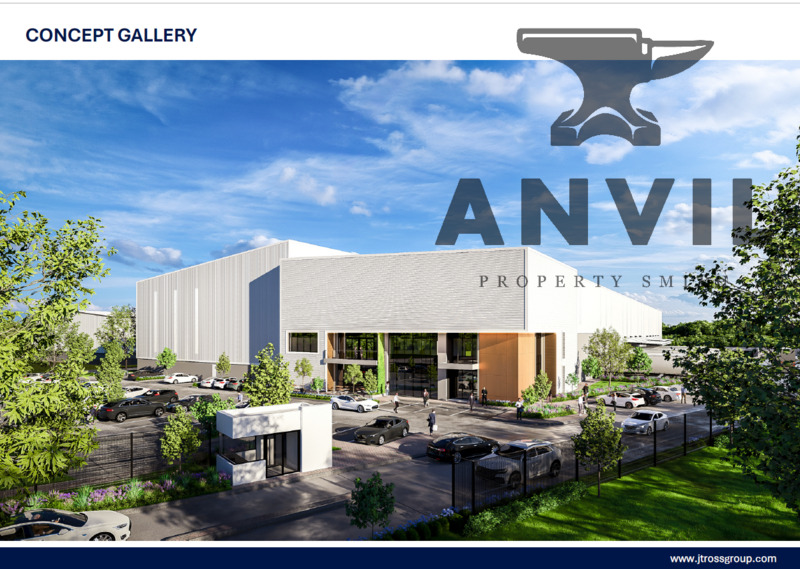

JT Ross - Plumbago Park 5

JT Ross has broken ground on multiple buildings here. Warehouses 2, 3, and 4 range from 4,000 to 10,727m² and are due online in August 2026. Warehouse 1 is still tenant-driven. These facilities feature:

- Overhead sprinklers

- 15.5m eave heights

- Large hardstand yards

- Solar PV readiness

- Dock levellers Net rentals are around R95/m² for warehouse space and R125/m² for office components.

NOKA Park (Feenstra & Growthpoint JV)

Breaking ground in 2026, this is one to watch. The park welcomes larger-scale distribution and supply chain operations with tenant-driven builds between 17,000 and 30,000m². Breaking ground is tied to signed lease agreements, so demand is clearly active.

Whether you need a compact 500m² starter unit or a 30,000m² national DC, Pomona's limited but high-spec stock can still deliver if you move decisively.

Incentives & Lease Options

The SEZ Zone is now active with ORTIA 1 fully operational. This precinct offers strong incentives to businesses setting up logistics or manufacturing operations, including:

- Lower corporate tax rates (15%)

- Relaxed import and export duties

- VAT exemptions

- Employment tax incentives

These benefits are designed to make Pomona even more competitive in attracting globally-focused enterprises.

But ORTIA 2 is the real game changer. This 28-hectare site is set to revolutionise Gauteng’s industrial capability. It’s not restricted to any specific type of business, but a clear set of qualifying criteria is used to evaluate incentive eligibility. The zone is currently undergoing bulk earthworks. Land parcels haven’t been released yet, but planning is in motion. Surface-level infrastructure for Phase 1 is expected to be in place by 2028.

This sets up Pomona not just as a strong local hub, but a serious launchpad for businesses eyeing the global stage.

Most leases in Pomona run 3 to 5 years. Longer terms often come with tenant installation allowances or better rates on new builds.

Rental Snapshot:

- R65/m² to R95/m² depending on size, age, and spec

- Ops costs generally billed separately

- Larger boxes or corner plots carry slight premiums

Lifestyle & Quality of Life

Pomona is industrial at its core, but staff convenience hasn’t been ignored. Glen Acres, Glen Ballad, and Harvest Place all sit nearby with retail, groceries, and service centres. You’ve got fast food, medical centres, banks, and gyms within a 10-minute drive. For logistics-heavy operations running shifts or needing nearby accommodation, this is a real plus.

Recruitment-wise, you’re close to major residential areas without the traffic pressure of city-bound nodes like Isando or Jet Park.

Final Thoughts & Broker Summary

Pomona works. It’s not overhyped or oversold. If your operation needs access to the R21, OR Tambo, and national routes, there’s no better-positioned node in Gauteng right now. Stock can be tight and high-spec buildings often lease out before completion, but if you move fast, you can still secure serious space here.

While availability is limited, opportunities still exist for the eager investor. Agricultural properties remain available, offering large stands ideal for standalone yards, bespoke facilities, or mini industrial warehousing.

Pomona is here to stay. And for investors and operators looking long-term, this node provides opportunities aplenty.

For current listings, site comparisons, or SEZ qualification guidance, speak to the team at Anvil Property Smith. We’ll walk you through options, highlight the best-fit parks, and make sure your lease aligns with your operational goals.